Little Known Questions About What Is Medigap.

Wiki Article

Things about Medigap Benefits

Table of ContentsUnknown Facts About How Does Medigap WorksThe Facts About Medigap Benefits UncoveredMedigap Benefits for DummiesSome Known Incorrect Statements About What Is Medigap What Is Medigap Can Be Fun For AnyoneExamine This Report about Medigap Benefits

A (Lock A locked padlock) or implies you have actually safely linked to the. gov site. Share delicate information only on official, safe and secure web sites.What really amazed them was the awareness that Medicare would certainly not cover all their healthcare prices in retired life, including those when taking a trip abroad. "We take a trip a lot and desire the security of understanding we can obtain clinical treatment far from residence," claims Jeff, who with Alison is expecting visiting her household in England.

"Also exclusive athletes encounter health problems as they move through the decades." "Speak to your medical professional concerning aging and have a look at your family members background," claims Feinschreiber. "It could be an excellent guide to aid make a decision the type of protection you might want to prepare for." Considering that there is no "joint" or "family" insurance coverage under Medicare, it might be extra affordable for you and your spouse to choose various coverage choices from separate insurer.

Some Known Incorrect Statements About Medigap Benefits

The Ottos realize that their demands might transform over time, specifically as they cut traveling strategies as they grow older. "Although we have actually seen boost over the last 2 years given that we enrolled in Medigap, we have the right degree of additional protection in the meantime as well as believe we're obtaining excellent value at $800+ per month for the both people including dental coverage," said Alison.For residents in select states, enlist in the ideal Medicare strategy for you with assistance from Fidelity Medicare Solutions.

Not every strategy will be available in every state. Medicare Supplement Insurance coverage is offered by personal insurance coverage business, so the price of a strategy can vary in between one provider or location and another. There are a few various other points that may influence the cost of a Medigap plan: The quantity of coverage provided by the plan Whether clinical underwriting is utilized as part of the application process The age at which you sign up with the strategy Eligibility for any kind of price cuts used by the copyright Sex (women usually pay much less for a plan than males) In order to be eligible for a Medicare Supplement Insurance coverage plan, you have to be at the very least 65 years of ages, signed up in Medicare Part An and also Part B as well as live in the location that is serviced by the plan.

9 Easy Facts About Medigap Benefits Shown

You are registered in a Medicare Advantage or Medigap plan provided by a company that misdirected you or was found to have not adhered to particular governing rules. Medicare Supplement plans and also Medicare Benefit prepares job really in different ways, and also you can not have both at the same time. Medicare Supplement plans job together with your Original Medicare coverage to assist cover out-of-pocket Medicare expenses like deductibles and coinsurance.Many strategies also offer various other advantages such as prescription drug coverage or dental treatment, which Original Medicare doesn't generally cover. Medicare Supplement strategy premiums can differ based on where you live, the insurance policy companies supplying plans, the prices structure those companies use and also the sort of strategy you look for.

The ordinary month-to-month premium for the very same plan in Iowa in 2022 was just $120 each month. 1 With 10 different kinds of standardized Medigap plans and an array of benefits they can supply (not to point out the series of month-to-month premiums for each and every plan), pop over here it can be helpful to make the effort to compare the Medigap choices available where you live - medigap.

The Best Strategy To Use For Medigap Benefits

You need to consider switching Medigap strategies throughout certain times of the year, however. Transforming Medicare Supplement prepares during the correct time can aid secure you from having to pay greater costs or being refuted insurance coverage because of your health or pre-existing problems. There are a variety of different Medicare Supplement Insurance business across the country.find more

You can find out more concerning them by contrasting business scores and checking out client testimonials. Medigap Strategy F covers extra out-of-pocket Medicare expenses than any type of other standard sort of Medigap plan. In exchange for their regular monthly premium, Strategy F recipients know that every one of their Medicare deductibles, coinsurance, copays and also various other out-of-pocket costs will certainly be covered.

com that educate Medicare recipients the very best techniques for navigating Medicare (What is Medigap). His articles read by hundreds of older Americans every month. By better recognizing their healthcare coverage, viewers may hopefully discover exactly how to limit their out-of-pocket Medicare investing as well as accessibility high quality treatment. Christian's enthusiasm for his role originates from his desire to make a difference in the elderly neighborhood.

The Best Guide To Medigap

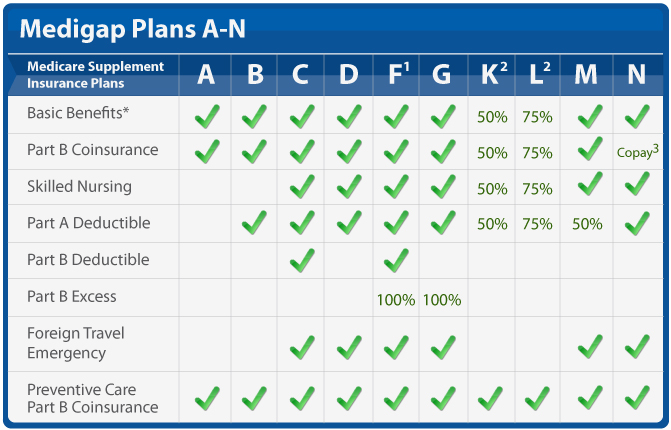

During that time structure, insurance provider are usually not permitted to ask you any type of health inquiries (additionally referred to as medical underwriting). Afterwards, you may need to respond to those questions, and also the responses might bring about a greater costs or to being declined for Medigap insurance coverage. A few exemptions exist.However, this is real only if they drop their Medicare Benefit protection view it now within twelve month of joining. Keep in mind: If you and also your partner both get Medigap plans, some insurance coverage suppliers will use a home discount. That depends on the strategy you pick. Medigap has 10 standardized insurance policy plans that are understood letters of the alphabet: Strategies A, B, C, D, F, G, K, L, M and N.

Nevertheless, within each strategy, the advantages are the same since they are standard. For example, a Strategy A plan will certainly have the same benefits whatever insurance provider you get it from. So, the trick is to identify which strategy offers benefits that are essential to you. After that you can contrast deals from insurance company to insurance provider to discover one of the most budget-friendly price for the strategy you desire.

Report this wiki page